Additional Buyer's Stamp Duty (ABSD) Rates

Correct as of 15/02/2023 (Latest)

| Additional Buyer's Stamp Duty | 1st Property Purchase | 2nd Property Purchase | 3rd Property Purchase |

|---|---|---|---|

| Singapore Citizens | Nil | 20% (Former 17%) | 30% (Former 25%) |

| Permanent Residents | 5% | 30% (Former 25%) | 35% (Former 30%) |

| Foreigners | 60% (Former 30%) | 60% (30%) | 60% (30%) |

| Misc: Trustees 65% (can claim back) | |||

Buyer Stamp Duty:

Purchase Price $360,000 to $ 1 million: (3% X Purchase Price – $5,400)

Purchase Price $1 million to $1.5 million: (4% X Purchase Price – $15,400)

Purchase Price $1.5 million to $3 million: (5% X Purchase Price – $30,400)

Purchase Price above $3 million: (6% X Purchase Price – $60,400)

Foreigners Eligible for ABSD Remission Under Free Trade Agreements (FTAS)

Under the respective (free trade agreement) FTAs, Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland and

Nationals of the United States of America.

ABSD Remission for Foreigners Married to Singaporeans

Now, although we’ve indicated earlier that ABSD is always levied on foreigners and Permanent Residents, there’s one instance where these individuals won’t need to pay it.

If you’re a foreigner or Permanent Resident who’s married to a Singaporean, and you don’t own any residential property, you don’t need to pay ABSD.

When multiple buyers of different profiles are jointly purchasing a property, the higher ABSD rate will apply on the purchase price or market value of the property, whichever is higher.

However, for married couples made up of Singaporean & Singapore Permanent Resident or Singaporean & Foreigner buying their matrimonial house, they are eligible to apply for remission of ABSD.

You can get an ABSD refund if you’re moving house as a married couple. To qualify for the refund, the property that you paid ABSD for needs to be sold within 6 months of you buying the second. You can view the full terms and conditions on IRAS’s website.

More FAQs on ABSD in Singapore

How can I avoid ABSD for a second home?

Tax evasion is illegal. Common legal ways around ABSD are decoupling, buying the property in your child’s name (under trust) and choosing dual-key condos. Read more here to learn how to legally avoid ABSD when buying a property.

Can ABSD be paid by CPF?

Yes, you can use CPF savings to pay the stamp duty and survey fees, including ABSD. However, for a resale property, since ABSD is payable within 14 days, you will need to pay cash first and seek reimbursement from your CPF account subsequently.

Summary

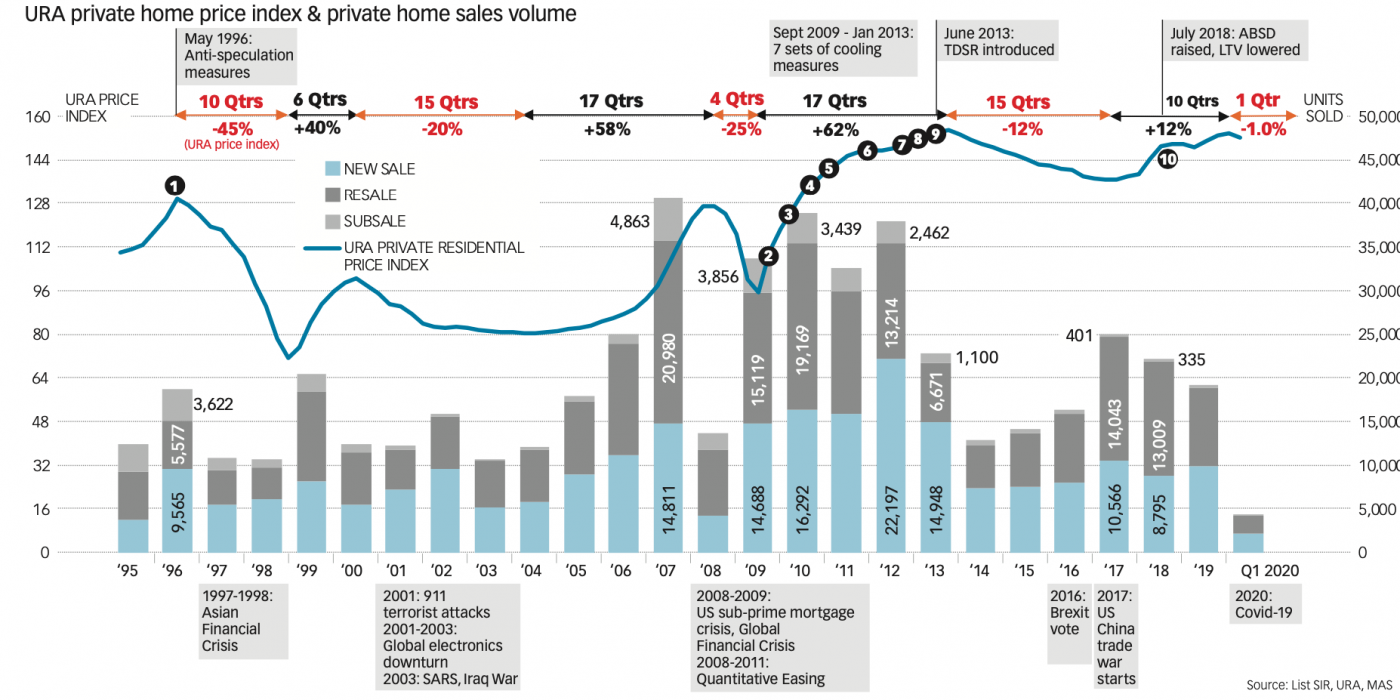

Impact of Major Property Cooling Measures

1. May 1996

- Gains from selling properties within three years of their purchase taxed as income. The tax was on 100 per cent of gains if the property was disposed of within one year of its purchase, two-thirds of the gain if property disposal was in the second year, and one-third if in the third year.

- Payment of stamp duty by buyer brought forward to the time of signing the sale and purchase agreement. Previously, a buyer who bought an uncompleted property need not pay stamp duty until the title was transferred to him. This allowed property speculators to buy and sell properties quickly without paying stamp duty, fuelling subsales.

- Seller’s stamp duty (SSD) introduced on residential properties sold within three years of purchase.

- Loan-to-value (LTV) limit, set at 80%, introduced for housing loans granted by financial institutions.

- Foreigners who are not Singapore permanent residents (PRs), and non-Singapore companies no longer allowed to be granted Singapore-dollar housing loans.

(The above measures were rolled back between Nov 1997 and July 2005)

2. September 2009

- Removal of interest absorption scheme (IAS) and interest-only housing loans (IOL) wef Sept 14, 2019

- Property-related Budget 2009 Assistance Measures to developers to expire when due.

3. February 2010

- Re-introduction of SSD. Rate set at up to 3% on all residential properties and residential lands bought on or after Feb 20, 2010, and sold within one year from the date of purchase.

- LTV limit lowered from 90% to 80% for all housing loans provided by financial institutions.

4. August 2010

- Holding period for imposition of SSD increased from one year to three years for residential properties bought on or after Aug 30, 2010.

- For property buyers with already one or more outstanding housing loans at the time of the new housing purchase, the minimum cash down payment raised from 5% to 10% and LTV limit lowered from 80% to 70%.

5. January 2011

- Holding period for imposition of SSD increased from three years to four years and SSD rates raised to 16%, 12%, 8% and 4% for residential properties bought on or after Jan 14, 2011, and sold in the first, second, third and fourth year of purchase respectively.

- LTV limit lowered from 70% to 60% for home buyers who are individuals with one or more outstanding housing loans, and to 50% on housing loans for all residential property buyers who are not individuals.

6. December 2011

- Additional Buyer’s Stamp Duty (ABSD) introduced, over and above the buyer’s stamp duty, on certain categories of residential property purchases.

- Highest ABSD rate of 10% imposed on foreigners and corporate entities buying any residential property in Singapore.*

- Singapore citizens owning two and buying the third and subsequent residential property to pay ABSD of 3%. PRs owning one and buying the second and subsequent residential property pay ABSD of 3%.

*Reliefs provided, including for qualifying developers and for purchases falling within the scope of Singapore’s free trade agreements.

7. October 2012

- Maximum tenure introduced for all new residential property loans, at 35 years.

- For loan tenure exceeding 30 years or loan period extending beyond the borrower’s retirement age of 65 years, LTV limit lowered to 40% for a borrower with one or more outstanding residential property loans and 60% for a borrower with no outstanding housing loan. This applies to borrowers who are individuals.

- For residential property loans to non-individual borrowers, LTV limit cut from 50% to 40%.

8. January 2013

- ABSD raised by 5 to 7 percentage points across the board.

- ABSD imposed on PRs buying their first residential property and on Singapore citizens buying their second residential property.

- Foreigners and corporate entities pay 15% ABSD for all purchases of residential properties.

- Tighter LTV limits on housing loans to individuals who already have at least one outstanding housing loan, as well as to non-individual borrowers such as companies.

- For individuals obtaining a second housing loan, LTV limit lowered by 10 percentage points to 50%, (or to 30% if loan tenure exceeds 30 years or loan period extends beyond the borrower’s retirement age of 65 years).

- For third or subsequent housing loans, LTV limit lowered by 20 percentage points to 40% (or to 20% if loan tenure exceeds 30 years or loan period extends beyond the borrower’s retirement age of 65 years). I For non-individual (corporate) borrowers, LTV limit halved to 20%.

- Minimum cash downpayment for individuals applying for a second or subsequent housing loan raised from 10% to 25%.

9. June 2013

- MAS introduced Total Debt Servicing Ratio (TDSR) framework, under which financial institutions granting property loans to individuals have to ensure a borrower’s total monthly debt obligations (including car loan and credit card repayments) do not exceed 60 per cent of gross monthly income.

- At the same time, MAS refined rules relating to the application of the existing LTV limits on housing loans, to prevent circumvention of tighter LTV limits on second and subsequent housing loans.

10. July 2018

- ABSD rates for Singaporeans and PRs buying their second or subsequent residential property increased by 5 percentage points.

I ABSD for foreigners buying any residential property raised to 20%, from 15% previously. - ABSD for corporate entities buying any residential property raised to 25% from 15%. Developers buying residential properties for housing development to pay an additional, non-remittable ABSD of 5% upfront upon purchase.

LTV limits tightened by 5 percentage points for all housing loans granted by financial institutions.

Source: Compiled by BT from various sources including MAS, MOF and URA

11. 16 December 2021

- ABSD rates for Singaporeans buying their second residential property increased by 5 percentage point while subsequent third or more residential property increased by 10 percentage points.

- ABSD rates for PRs buying their second residential property increased by 10 percentage point while subsequent third or more residential property increased by 15 percentage points.

- ABSD for foreigners buying their property increased by 10 percentage point.

- ABSD for corporate entities buying any residential property raised to 35% from 25%. Developers buying residential properties for housing development to pay an additional, non-remittable ABSD of 5% upfront upon purchase.

- TDSR threshold will decrease from 60% to 55%. This means new mortgages cannot cause borrowers’ total monthly loan repayments to exceed 55 per cent of monthly income.

LTV limit for HDB housing loans will now be cut from 90 per cent to 85 per cent. This reduces the maximum amount potential homeowners can borrow from HDB.

Source: Compiled by BT from various sources including MAS, MOF and URA

12. 08 May 2022

- Additional Buyer’s Stamp Duty (ABSD) of 35% will apply on any transfer of residential property into a living trust, where the transfer occurs on or after 9 May 2022.

- ABSD (Trust) is to be payable upfront, when the residential property is transferred into any living trust. As a concession, a trustee may apply to IRAS for a refund of ABSD (Trust), provided that the following conditions are met:

13. 30 September 2022

- For MSR/TDSR computation: Use the higher of *4% per annum (p.a.) floor* or the thereafter interest rate*.

- Loans taken directly from HDB (HDB applications from 30 Sept 2022 onwards): HDB will use an interest rate floor of 3% to compute loan eligibility. Loan-to-Value (LTV) limit for HDB housing loans from 85% to 80%. HDB concessionary interest rate, which will remain unchanged at 2.6% p.a.

- Imposed wait-out period of 15 months for private residential property owners (PPOs) and ex-Private Property Owners to buy a non-subsidised HDB resale flat. The wait-out period will not apply to seniors aged 55 and above downgrading from private property to HDB.

14. 26 April 2023 (Latest)

Raise ABSD rate from 17% to 20% for Singapore Citizens (SCs) purchasing their 2nd residential property;

Raise ABSD rate from 25% to 30% for SCs purchasing their 3rd and subsequent residential property, and Singapore Permanent Residents (SPRs) purchasing their 2nd residential property;

Raise ABSD rate from 30% to 35% for SPRs purchasing their 3rd and subsequent residential property;

Raise ABSD rate from 30% to 60% for foreigners purchasing any residential property; and

Raise ABSD rate from 35% to 65% for entities or trusts purchasing any residential property, except for housing developers.