New Launch vs Resale Properties in Singapore | An In-depth research on profit margin

- Case Study 1: Sky Vue vs Bishan 8 (2013)

- Case Study 2: The Panorama vs Grandeur 8 (2014)

- Case Study 3: Botanique at Bartley vs Bartley Residences (2015)

- Case Study 4: Kingsford Waterbay vs Rio Vista vs The Florida (2015)

- Case Study 5: High Park Residences vs Compass Heights (2015)

- Case Study 6: Kingsford Waterbay vs Kovan Melody (2015)

- Case Study 7: Stars of Kovan vs Kovan Residences (2016)

- Case Study 8: Clement Canopy vs Queens (2017)

- Who are Resale Properties for?

- Is it Worth to rent while waiting for a New Launch?

Over the years, many of my clients have asked me the very same question “James, why do you recommend me a new launch when its price is higher, and when it is still under construction? Why not recommend me a resale property which I can immediately rent out to earn some quick bucks?”

I’m here to clearly address this question today. In today’s post, we shall compare the properties in Singapore that are brand-new (New Launches) against Resale properties. In doing so, we will show examples from 2013-2017 (in order to eliminate the market cycle variable) to answer these four important questions:

- Does distance to MRT station matter?

- Does distance to city centre matter?

- Does the lease of the property matter?

- Which of the above three is the most important when we are considering return of investment when it comes to properties?

Without further ado, let’s get cracking!

New Launches vs Resale (2013) – Sky Vue vs Bishan 8

In 2013, Sky Vue, a new launch then, is a property that is further away from Bishan MRT station as compared to Bishan 8, a resale property that is situated right next to Bishan MRT station.

Now, take a look at the Sales Transaction Trend above. You’ll notice that in 2013, the price of Bishan 8 is $1,166 psf as compared to Sky Vue, which saw a psf price of $1423 in the same year. Buyers in 2013 could choose a cheaper resale unit or choose to buy a brand-new unit that was more expensive, and which required them to wait for a few years for construction to complete.

Fast forward a few years to 2021, however, you see a different trend. Bishan 8 has seen an increase of psf price to $1,242. While Sky Vue’s price is now $1,741 psf. In other words, Bishan 8 saw a return of investment of 6.1% while Sky Vue gave buyers a whopping 21.5% return of investment.

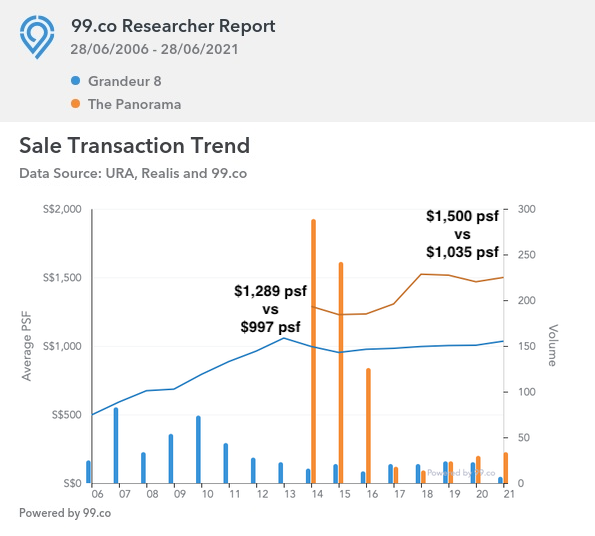

New Launches vs Resale (2014) – The Panorama vs Grandeur 8

Perhaps that was just Bishan. Let’s take a look at neighbouring Ang Mo Kio. Here The Panorama, a brand-new development, is further away from the MRT station as compared to Grandeur 8, a resale property nearer to the MRT station.

In 2014, Grandeur 8 was $997 psf and The Panorama was $1,289 psf. Today, we see that the former sees a price of $1035 psf while the latter sees a price of $1,500 psf. What does that mean? Well, that’s a 16% return of investment (The Panorama) as compared to a tiny 3.6% of return of investment (Grandeur 8).

As evidenced by The Panorama in 2014 and Sky Vue in 2013, the distance that a property is located away from an MRT station does not matter when comparing a new launch with a resale property.

Another trend that is consistent and worth noting is that property prices tend to rise at the beginning stage until a new development is to be launched in its vicinity. When that happens, prices start to stagnate.

For 2015’s case study, we’ll look at new launch Botanique at Barley and compare it to a resale property, Bartley residences. Both properties are situated close to the MRT station. Interestingly, for this case, there isn’t any available land for any further new launches in the area. This is why there doesn’t seem to be any growth in prices, as seen from the trend chart above.

Yet, we still see that Botanique at Barley, the new launch, saw an increase in psf price from $1,287 to $1,551as compared to Bartley Residences, which saw an increase from $1,213 to $1,368. In terms of return of investment, the new launch saw 20.5% as compared to the resale property’s 11.3%.

New Launches vs Resale (2015) – Rio Vista vs The Florida vs Kingsford Waterbay

We’ll look at another example from 2015. Here, we’ll look at three properties from Upper Serangoon View—Kingsford Water Bay, a new launch, and two resale properties, Rio Vista and The Florida just next to Kingsford Waterbay.

As seen from above, Kingsford Waterbay was sold at $1,111 psf, as compared to $775 and $686 (Rio Vista and The Florida). But moving forward, in 2021, Kingsford Waterbay made a 14.2% return of investment as compared to 6% and 5.1% for Rio Vista and The Florida.

Another thing that you might have noticed is that the prices of Rio Vista and The Florida started to grow until it started to stagnate when Kingsford Waterbay was launched. When the prices of the two properties stagnated, the price of Kingsford Waterbay continued to rise.

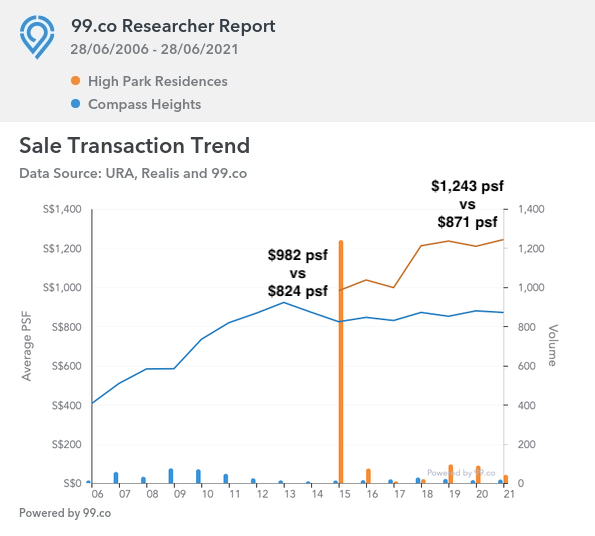

New Launches vs Resale (2015) – High Park Residences vs Compass Heights

The next example, also from 2015, is a comparison between Compass Heights, a resale property close to MRT and High Park Residences, a new launch far away from the MRT station.

In 2015, Compass Heights was priced at $824 psf, while High Park Residences was $982 psf. In 2021, we see that High Park Residences grew by a large 26.6% return of investment as compared to Compass Heights, which saw a return of investment of 5.3%.

Once again, this begs the question: Does being close to an MRT Station matter? Clearly, in this case, it really doesn’t! The lease of the property matters MORE than distance to MRT. The key is to find the right project that is fundamentally strong.

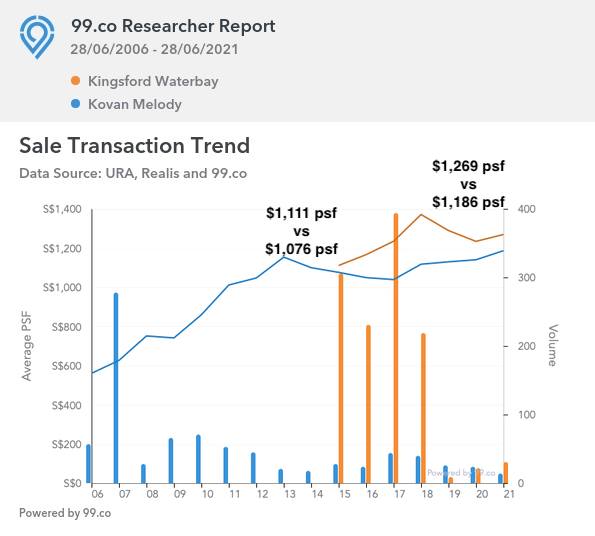

New Launches vs Resale (2015) – Kingsford Waterbay vs Kovan Melody

This next example will further illustrate why distance to MRT station isn’t all that important as compared to the lease of the property. We’ll compared resale property Kovan Melody that is next to the MRT station, and Kingsford Waterbay, which has no MRT station nearby.

In 2015, Kingsford Waterbay was selling at $1,111 psf, pricier than the $1,076 psf that Kovan Melody was selling at. When we look at 2021’s data, we see that Kingsford Waterbay sees a return of investment of 14.2% as compared to Kovan Melody’s 9.2%. Once again, it shows us that a property that is brand-new and with a longer lease term, will see a higher return of investment!

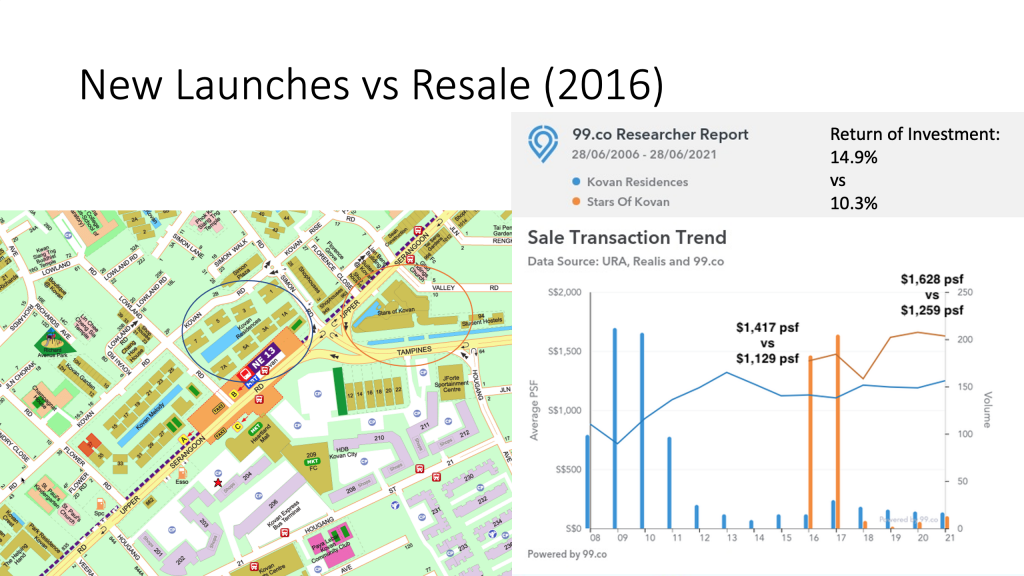

New Launches vs Resale (2016) – Kovan Residences vs Stars of Kovan

Now, we’ll look at two properties that are both near to an MRT station. First, we have Kovan Residences, a resale property, and second, a brand-new development in 2016 that is right opposite the first property, Stars of Kovan.

In 2021, we see once again, consistent with our other examples and data that Stars of Kovan’s return of investment is 14.9% compared to resale property Kovan Residences’ 10.3%.

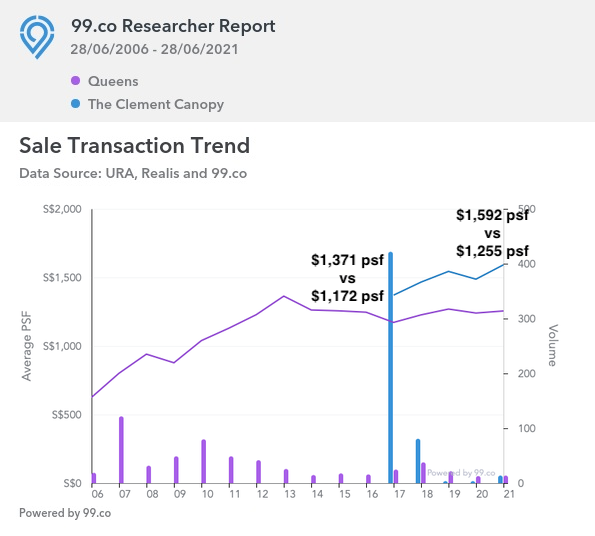

New Launches vs Resale (2017) – Clement Canopy vs Queens

For the final example, we will determine if distance to city centre matters. We’ll look at two projects, Queens, an old resale development, and Clement Canopy, a new development that is not near to an MRT station and further away from the city centre as compared to Queens. In 2017, Queens sold for $1,172 psf while Clement Canopy launched at $1,371 psf, as seen from the chart below.

Taken together, Clement Canopy grew by 16.1% as compared to Queens which saw a return of investment of 6.6%. In other words, this not only shows us like the previous examples that distance to MRT is not a major criterion. It also shows us that distance to city centre is not as important as well. The most important factor, is in fact, the lease of the property—buying a brand-new property with a longer lease, will give you a greater return of investment.

Who are Resale properties for?

Now, you may have a question in your mind “If everyone knows that buying a new launch is more advantageous, why are people still buying resale properties? Who are they for?”

Well, as the saying goes, there is something for everybody. In this case, resale properties are for:

People who have not done their research: Without a comparison analysis, they will not be able to understand why it is better to buy a new launch project. It could also be that

People who need a place to stay immediately: People who need a house for their own stay and unable to wait for years for a building to construct are likely to opt for a resale property.

People who can’t afford to pay the ABSD upfront: In other words, these are the people who are not able to buy a new property before selling their old property. They have to sell their old property before being able to afford the newer property. Since they do not have the sum for their ABSD they will prefer to opt for resale properties. It may also be because they can’t find any other ways to avoid the ABSD, either by Decoupling or buying through Trust.

People who are looking only at Rental Income: Another group of people who would likely look at resale properties are those that are not focused on Capital Appreciation. Instead, they would be more focused on Rental Income that the immediate property will bring them.

I would like to buy a new launch…but?

By now, you may be wondering: James, I want to buy a new launch, but I stay in a HDB, can’t do a decoupling and can’t afford to pay ABSD first. Should I go ahead and buy a brand-new property and rent a home in Singapore first, or just buy a resale property? In other words, is it worth renting a place while waiting for your new launch condo?

Look at the table above based on a new launch property that costs $1,000,000 as an example. If you choose to buy a new launch and rent a condo while waiting for it to build, you’ll have to fork out $2,500/month for a four-room HDB unit. For a resale flat, no rental fees apply because you have an immediate place to stay.

Beyond that, however, when you look at Interest, Property Tax and Maintenance, you’ll actually notice that you’ll save more if you opt for a new launch. You’ll have to fork out $2,063/month if you buy a resale as compared to $2,800/month for a new launch. But when you take into account renovation, new launches save you some money. Put another way, if you have to look for a place to rent while waiting for your new launch instead of purchasing a resale unit, you will ultimately save some money in total ($124,268 for resale and $105,800 for new launch)

The Bottom-line

If you remember one thing and one thing only, here it is: The age of the property matters the most. The distance it is to an MRT station and the city centre? Not so much. As seen from the case studies above, brand-new developments make double digit returns in a few years as compared to resale properties that typically see lower return of investments.

In addition, as mentioned above, property prices tend to rise at the beginning stage until a new development is to be launched in its vicinity. When that happens, prices start to stagnate. Therefore, as compared to resale properties that are a safer bet new launch projects have stronger capital gain upside. Why, you may ask? That’s because for new launches, banks can match its valuation. On the other hand, resale properties have to match valuation.